Are we heading for a construction labor apolalypse?

11/09/2021

The makings of a perfect storm for an historic construction labor crunch

The makings of a labor apocalypse are all there.

Current labor shortage? Check.

Accelerating economic recover? Check.

Historic infrastructure spending? Check.

Vaccination mandate? Check.

Are we looking at the perfect storm for construction labor disruptions? Unfortunately, we believe the answer is “yes” and it’s looking like early 2022 for the impacts to set in.

What’s the current situation with construction labor?

Before we look at what’s ahead, let’s set the stage for construction labor as it stands today. As of early November 2021, the construction industry is already dealing with a labor shortage.

From October 2021’s employment data, construction unemployment is at 4%. This is a 24-month low dating back to October 2019, well before the impacts of COVID began.

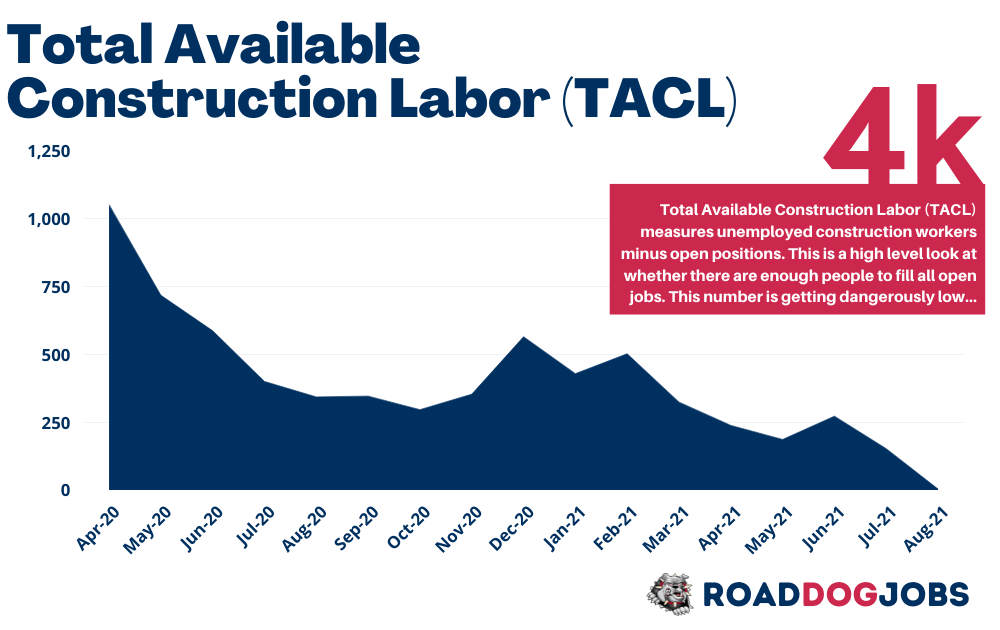

At Road Dog Jobs we measure Total Available Construction Labor (TACL) which compares the unemployed construction workforce with open jobs.

TACL is a macro measure of whether there are enough people in the industry to fill the open jobs. As this number approaches zero – or worse goes negative – the industry is in a position where, mathematically, there aren’t enough people to fill open jobs.

As of August 2021 (the latest available data) TACL stood at 4,000 people. This means that subtracting open jobs (365,000) from unemployed construction workers (369,000) there were just barely enough people to cover the open jobs.

Historically, as TACL drops below 100,000 the industry is experiencing a labor shortage. Suffice it to say that 4,000 is a very concerning number – and one that we expect to get worse over the coming months.

Is construction economic recovery in full swing?

The answer here is depends on which part of construction you’re talking about.

The post-COVID employment surge in construction has been driven primarily by residential construction. The housing market has been white hot. Accordingly, spending on residential construction increased from 42% of the total construction market in April 2020 to almost 50% of construction spending in September 2021. These residential construction spending numbers are multi-year highs.

On the other hand, commercial and industrial sectors have yet to see a bounce back in spending. While residential construction regained its pre-COVID spending rate by August 2020, non-residential construction spending still over 10% off its pre-COVID levels.

Non-residential spending will return, and when it does, watch out. Non-residential construction projects are large and labor intensive. The return of non-residential spending will mean a further tightening of available construction labor – in a market that already has very little room to tighten.

By Road Dog Jobs estimates, returning non-residential spending back to its pre-COVID levels will take over 150,000 additional people in the workforce from today’s employment levels. These are scary numbers in an industry where there aren’t enough people to fill those jobs.

What will the impact of the infrastructure bill be?

Whether you’re a supporter of the bill or not – it means more projects, more jobs and another factor impacting the construction workforce.

Which labor pool the bill impacts most remains to be seen. There are details of the bill involving project labor agreements with the intent of steering work toward union labor. The net result – regardless of whether union or non-union labor is doing the work – is that the projects will take capacity out of the system.

Let’s look at the numbers. The bill includes $550 billion in new civil works spending – presumably over a ten (10) year period. That means $55 billion in spending, on average, each year. Labor represents between 20% and 40% of cost on a construction project. With $55 billion in spending annually, a conservative labor requirement is $11 billion annually. Labor rates can vary, but using a labor cost of $50 per hour would mean the industry would need an incremental 110,000 construction workers to meet the demand (assuming 2,000 hours worked per year).

In a tightening labor environment, it’s hard to see where these 110,000 people are going to come from.

The vaccination mandates are coming too, what will that do to construction labor?

The impacts are going to be varied, and nobody knows for sure what will happen.

Some areas of the country will be significantly impacted. Others barely at all.

Some companies will be seriously impacted. Some companies will thrive. Some believe that smaller construction firms with less than 100 employees may reap the benefits of their size.

This is a big topic, and it deserves a deep dive to understand the impacts, which we are not going to do in this article.

The thing we can say will a large degree of confidence is that the mandates will bring a level of confusion and disruption to the construction labor market. This will settle out over time, but the timing could not be worse.

What will 2022 look like for construction labor?

The impacts on construction labor will start early in 2022. Construction unemployment will continue to fall, non-residential recovery will begin to accelerate, infrastructure spending will ramp up just as the vaccine mandate is rolling out. We’ve identified 260,000 additional people required just from infrastructure and non-residential construction returning to pre-COVID levels. We believe these are both conservative numbers.

2022 will bring confusion as well as opportunities. There will be winners and there will be losers.

The good news is that – if everything stays on track – the problems will be driven from abundant work. These are good problems to have, especially for an industry that saw so many impacted by COVID.

What can you do to prepare?

There are several things that you should be doing to prepare for this coming situation.

- Review contracts for change of law and force majeure provisions

- Build in adequate labor contingencies for rising labor rates

- Develop and rollout a construction labor strategy to attract the best people

- Set up incentive programs to retain your best people

- Establish clear selection criteria for pursuing the best fit projects for your company

Road Dog Jobs has a plan for you

As the labor market continues to tighten, finding good people will become more and more difficult. Nothing is worse than looking to fill a job and not getting any response or quality candidates. These high paying construction jobs shouldn’t be so difficult to fill.

The problem is that most recruiting tools were not built for construction. The people that make a living in construction are a unique group that need a unique approach.

Road Dog Jobs was built exclusively for traveling construction jobs that pay per diem. With over 60,000 registered job seekers and 190,000 social followers, Road Dog Jobs has the audience you need to get your jobs filled quickly so you can get back to growing your business.

If you’re looking for ways to better recruit the traveling construction work force, send us a note at hello@roaddogjobs.com and we’ll send you a free report on how best to recruit the traveling construction workforce.